Dunned Inventures is reader supported. When you invest through our links, we may earn a small commission at no extra cost to you

Rosland Capital was established in 2008 by industrialist and precious metals enthusiast Marin Aleksov and it swung into full operations in its headquarters situated in LA, California.

Although Rosland's circumference of operations is drawn around the United States market, it has expanded its horizon to Europe- UK and Germany- where the company was branded Rosland UK and Rosland GmbH, respectively.

Rosland's memorandum of action is:

“To present to their customers the opportunity of financial liberation and security through investing in different physical assets by indulging them to take a proactive approach by investing in gold, and implementing a surreal level of protection for their assets, so that investments are not lost over another economic downturn, which in actual sense, is imminent.

Pros:

Cons:

Rosland Capital Rating

Founded over 40 years ago with zero complaints to the Better Business Bureau (BBB) and Business Consumer Alliance (BCA), Augusta Precious Metals offers unrivaled customer support specializing 100% in gold and silver IRAs. Not to mention Joe Montana asked to be an ambassador for this company.

Products Offered

Customer Support

Fees

With the alarming level of ambiguity embedded in the DNA of the world's economy, it has been predicted that the purchasing power we possess now may be lost when financial institutions fail us. I mean, have you seen the vast US national debt yet?

In these times, if there is no diversification in place for all your resources, one may not survive the rigorous test of inflation. Diversification in this sense does not mean expanding your portfolio with investment in stocks and bonds. Yes, those are good assets, but they decline in value at an expedited rate like the US dollar.

Physical assets (Precious metals) are a proven hedge against inflation. When the value of dollars declines, their value increases astronomically. According to experts in the industry, these precious metals are the best investment for retirement living.

Who Owns Rosland Capital?

In 2008, Marin Aleksov took a giant leap when he established Rosland Capital and appointed himself to oversee its routine operations. He has since proved to be the most instrumental force piloting the progression and expansion of all the company's activities. The pacemaker!

In addition to his role as the company's CEO, Aleksov is intently involved in the customer service department. He made it his duty to ensure that all customer needs are met to the latter and even exceeded.

The wealth of knowledge that accompanies his years of global experience in the industry has made him share the stage (or the scene) with top radio and TV personalities of reputable shows like TheStreet, CBS News, the Los Angeles Times, etc., as an active industry correspondent and reviewer.

In 2015, Marin worked closely with John Watson to publish "The Rosland Capital Guide to Gold.”

The book provides an insight into the advent of gold coins through the years. It describes essential facts about collectible gold and silver coins from the US, Canada, the UK, and Europe and the enthralling details of coin grading and what to look out for when buying a coin.

The book also engages its readers on purchasing gold, including an IRA within an asset portfolio, and how Rosland Capital can expedite the process.

For every copy sold, Rosland Capital will donate $10 to the American Red Cross to support its services to veterans. The proceeds will help military and veterans in need to get back on their feet and recover from physical and mental injuries by providing relief through deployment, creating a viable communication pathway in times of emergency, and enhancing a safe reunion with their families at the end of service.

Why Invest In Precious Metals From Rosland Capital?

Investing in precious metals is one proven way to safeguard your financial future. Still, the success of your investment will be primarily determined by the nature of the company to which you entrust your financial credentials and assets.

Rosland Capital's specialty is investing in metal-based commodities, which are less volatile than physical commodities. This, coupled with the assurance of an outstanding level of customer service, will bolster your confidence and trust in the company as you aspire to purchase precious metals for your gold investment retirement account.

Do not worry about yourself. They will go out of their way to instruct and help you acquire Gold IRAs for your portfolio by making sure that you understand the options available to you to the latter.

Who Is Rosland Capital Suited For?

Rosland Capital's IRA is explicitly created for individuals interested in financial security through investments in precious metals. For clarity, you are exclusive to Rosland Capital's services if you fall under any of these categories:

How Does Rosland Capital Work?

After successfully funding your investment, Rosland Capital will transfer your gold or silver (or other precious metals) to a fully insured depository in Delaware. Each investor's metals are stored in a well-designated vault separate from everyone else's assets. Unlike many other companies, Rosland only has one secure storage vault.

After you are required to pay your annual fees to your IRA custodian for account management and storage, and that is it. Only you and your custodian have access to the vault to reduce the risk of adulteration of any kind.

Rosland Capital | Summary |

|---|---|

Products Offered | Premium Gold & Silver, Gold & Silver Bullion For IRA |

Precious Metal Storage | Multiple Locations Across Canada & USA |

Minimum Purchase | $10,000 |

Fee Structure | $50 setup fee. $225 storage and admin fee. |

Shipping | Free. 5-10 Day Delivery Time |

Insurance | Fully Insured Shipments |

Products Offered

The array of products available to customers of Rosland Capitals include:

What Are Gold Bars?

Gold bars are the most rudimentary form of gold product available to customers of Rosland Capital. Traders and short-term investors are the most favored buyers of gold bars, mainly bars weighing 32.15 ounces and above, which are usually beyond the means of most people.

Whether you buy gold bars or not depends on what your objectives are. If you are considering a small purchase, gold bars are a good option.

What Are Gold Coins?

You could imagine gold coins as an endorsed physical commodity of a fixed universal value as it purports to be. Without coins, gold will only be available in the form of a bar, and only the maker or seller knows the gold content of a bar unless they weigh and analyze it. Coins take the uncertainty out of buying gold, but both are an excellent investment.

Again, whichever you use depends on your objectives of investment. There is usually a plan that caters to you.

Two of the most popular bullion coins are the American Eagle and Canadian Maple.

Minimum Purchase

The minimum purchase you can make with a Rosland Capital gold individual retirement account is $10,000.

Fees

There will be a fee of $50 to set up your Rosland Capital gold IRA for starters. The annual storage and administration fee costs about $225.

Shipping and Insurance

Rosland Capital ships assets after purchase, but before the shipping event, the company appraises the market value of your assets and insures them at the appraised value. Rosland Capital has a seven-day delivery window and a compensatory product that does not meet the set date. They take full responsibility for your assets through the shipping window till you confirm the safe deposition of your precious metal.

Rosland Capital Reviews & Complaints

Over the years, Rosland Capital has an impressive digital footprint and positive reviews from top companies. At Rosland Capital, their policy is that customers deserve good service, so they pride themselves on providing a 99.9% rated service to customers. Rosland Capital educates its customers and bolsters their confidence in investment in precious metals. The impressive record of accomplishment of endorsements by investors and industry commentators is well deserved.

Rosland Capital holds an A+ rating from the Better Business Bureau (BBB). The Business Consumer Alliance (BCA) gives the company an outstanding AAA rating.

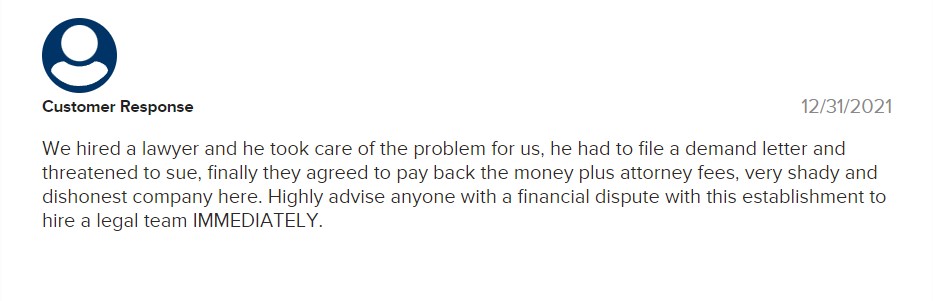

However,

They have a history of complaints strewn on the internet, especially BBB and TrustLink websites. Some reviewers despise the company, complaining about aggressive sales, ill-mannered agents, and difficulty reaching customer service. They are currently not a recommendable company to partner with scores like this.

Rosland Capital Lawsuit

Another issue that has proved to dent Rosland's reputation is the several court cases lined up for them by disgruntled customers and clients. One notable mention is the case of an 82-year-old WILLIAM DENNISON who sued the company because he had no experience investing in precious metals and was misled by the company's representative, Mr. Smith, after watching a television commercial.

Unfortunately, Mr. Dennison was eventually defrauded of a whopping $49,982.

Although Rosland solicitors argued that there was no Customer Agreement and the petition was denied, cases like this all over the place are sure to cause mistrust in the system.

Free Investors Kit From My #1 Recommended Company

How To Open A Gold IRA With Rosland Capital

The several petitions against them and the number of indecent consumer reviews have not made Rosland Capital the best option to work with. Still, one thing you cannot take away from them is the simplicity of their account opening process.

If you wish to work with Rosland, you can open a gold IRA account by following these three steps:

Step 1

Visit their website and fill out the contact form. Let them know you want to open a gold IRA.

Step 2

Make a call to the company to discuss your IRA options and ask any questions.

Step 3

From there, you will speak to a representative who will take you through the rest of the process.

Frequently Asked Questions About Rosland Capital

Is Rosland Capital Trustworthy?

In all fairness, every business venture will have its share of difficulties. Rosland Capital might not have an impeccable reputation, but it is a legitimate company that has been in the precious metals industry for 14 years now.

The question of whether they are trustworthy after the undesirable reviews, negative comments, and complaints is up to you to answer.

Different customers alleged that their representatives are not professional enough, the prices of the precious metals are not updated with their market value, and sometimes, they are delivered with the wrong item. Mistakes are expected in business, but the company may not be recommendable when repetitive.

Before you invest, ensure that you conduct adequate research before diving in. Also, ensure that the Customer Agreement is signed by both parties and properly documented.

How Long Has Rosland Capital Been In Business?

2008. Marin Aleksov established the company in 2008. That is 14 whole years of active business!

Does Rosland Capital Send You Gold?

As mentioned earlier, Rosland Capital ships the assets to the owners after they purchase them or on request. Before shipping, they appraise the asset's market value and insure it at the appraised value. However, shipping a precious metal like Gold needs to be done with utmost security.

So, while the gold is being shipped, they provide a trackable shipping number for your order. In the case of large orders (by institutions), they partner with private security services to provide security.

Final Thoughts

Based on the many negative reviews, I would not recommend investing with Rosland Capital. Especially with other great options on the market. I would highly recommend reading my Augusta Precious Metals review or get your free investors kit below as this is my #1 rated company based on their unparalleled customer support and having ZERO complaints since their inception in 2012.

A+ BBB Customer Rating

4.9/5 Consumer Affairs Rating

AAA Business Consumer Alliance Rating

5/5 Trust Link Rating

About Roy Guller

I have been an investment adviser for more than 30 years and managed more than 500 million dollars for my exclusive group of clients. My expertise lies in retirement funds and I want to share my wealth of experience with you so you can make the right decisions for your future.

You Might Also Like These...